The Networking Titans: Analyzing Software-Defined Wide Area Network Market Share

In the highly competitive and rapidly evolving enterprise networking sector, market share is the definitive scorecard, indicating technological leadership, customer trust, and strategic execution. A detailed analysis of the Software-Defined Wide Area Network Market Share reveals a dynamic battlefield where established networking giants, innovative pure-play specialists, and major cybersecurity firms are all vying for dominance. Market share in this context is a crucial measure of a vendor's ability to convince enterprises to abandon their legacy WAN infrastructure and adopt a new, software-defined approach. It reflects not just the quality of the technology but also the strength of a company's sales channels, its partner ecosystem, and its vision for the future of networking. Understanding this distribution of power is essential for any enterprise selecting a strategic SD-WAN partner, as it highlights the vendors with proven track records and long-term viability.

The market share landscape is led by a mix of traditional networking powerhouses and companies that were pioneers in the SD-WAN space. Networking giant Cisco holds a leading position, leveraging its massive installed base of routers and its extensive enterprise customer relationships. Cisco has successfully transitioned many of its existing customers to its SD-WAN solutions (both its Viptela and Meraki platforms). Another major player is VMware, which acquired SD-WAN pioneer VeloCloud and has integrated it tightly with its broader virtualization and cloud portfolio, making it a strong choice for existing VMware customers. Fortinet has also captured a significant market share by taking a security-first approach, tightly integrating its strong SD-WAN capabilities with its industry-leading next-generation firewall, appealing to security-conscious organizations. These leaders have established their positions through a combination of strong technology, strategic acquisitions, and powerful go-to-market engines.

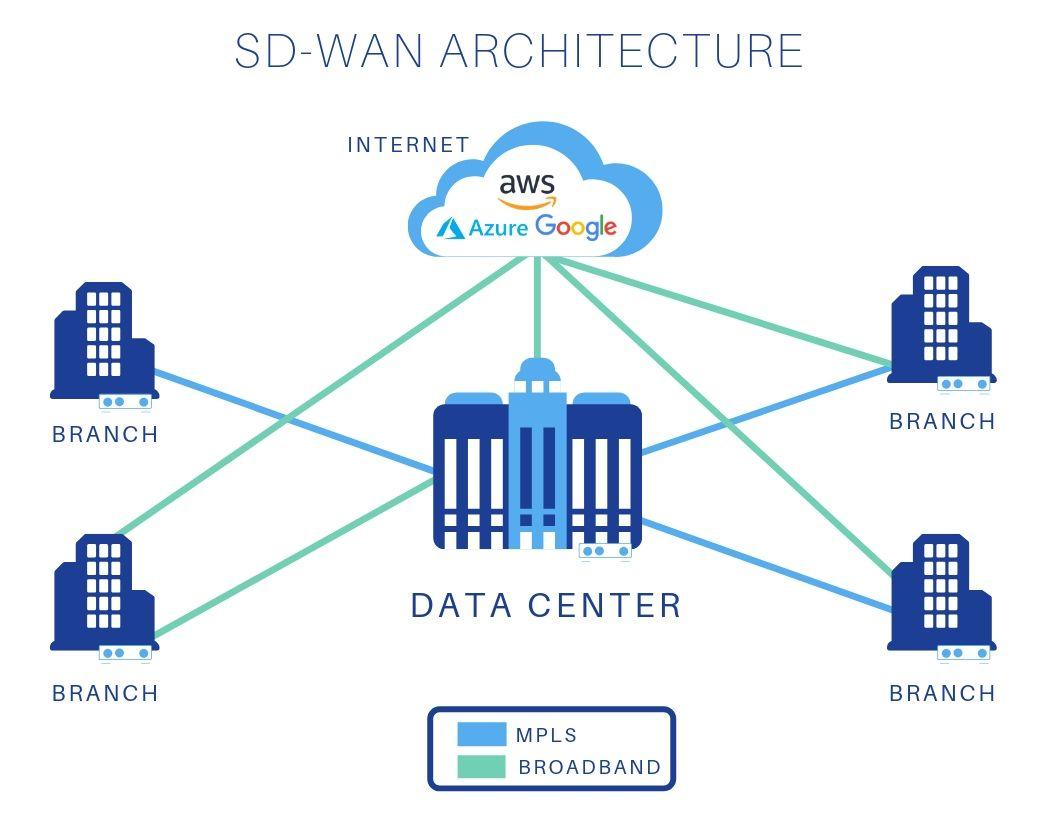

The strategies employed by these market leaders to capture and defend their market share are multifaceted and aggressive. Strategic acquisitions have been a key theme in the industry, with nearly all the major players having acquired a pure-play SD-WAN startup to jumpstart their entry into the market. Continuous feature innovation is another critical battleground. Vendors are constantly adding new capabilities, particularly in the areas of security, cloud integration, and AI-driven operations (AIOps), to differentiate their offerings. Building a strong channel partner ecosystem is also vital. The vast majority of SD-WAN solutions are sold and deployed through value-added resellers (VARs) and system integrators, so having a well-trained and motivated partner network is crucial for reaching the broad enterprise market. Finally, forming deep technology alliances with major cloud providers (like AWS, Azure, and GCP) is essential for ensuring seamless and optimized multi-cloud connectivity, which is a key customer requirement.

A crucial and often overlooked aspect of the market share equation is the role of telecommunication service providers (telcos) and managed service providers (MSPs). The Software-Defined Wide Area Network Market size is estimated to reach a value of USD 32.167 billion by 2024 to 2032 With a CAGR of 21.3%, and a huge and growing portion of this is for managed SD-WAN services. Many enterprises prefer to consume SD-WAN as a fully managed service from their trusted telco partner rather than deploying and managing it themselves. As a result, the telcos have become a major channel to market for the SD-WAN vendors. The vendors who are most successful at partnering with major telcos like AT&T, Verizon, and Orange—getting their technology selected as the underlying platform for the telco's managed service offering—gain a massive advantage in market share. This indirect, service provider-led route to market is a defining characteristic of the industry's competitive dynamics.

Explore Our Latest Trending Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness