In-vitro Colorectal Cancer Screening Tests Market Entering a Decade of High-Impact Innovation and Global Screening Expansion Through 2034 – A Comprehensive Industry Transformation Summary

The global In-vitro Colorectal Cancer Screening Tests Market is stepping into a decade shaped by rapid technological advancements, broadening access to non-invasive diagnostics, and an intensifying global push toward early cancer detection. With colorectal cancer (CRC) continuing to be a leading cause of cancer-related mortality worldwide, the adoption of advanced in-vitro screening methods has become a top priority across healthcare systems.

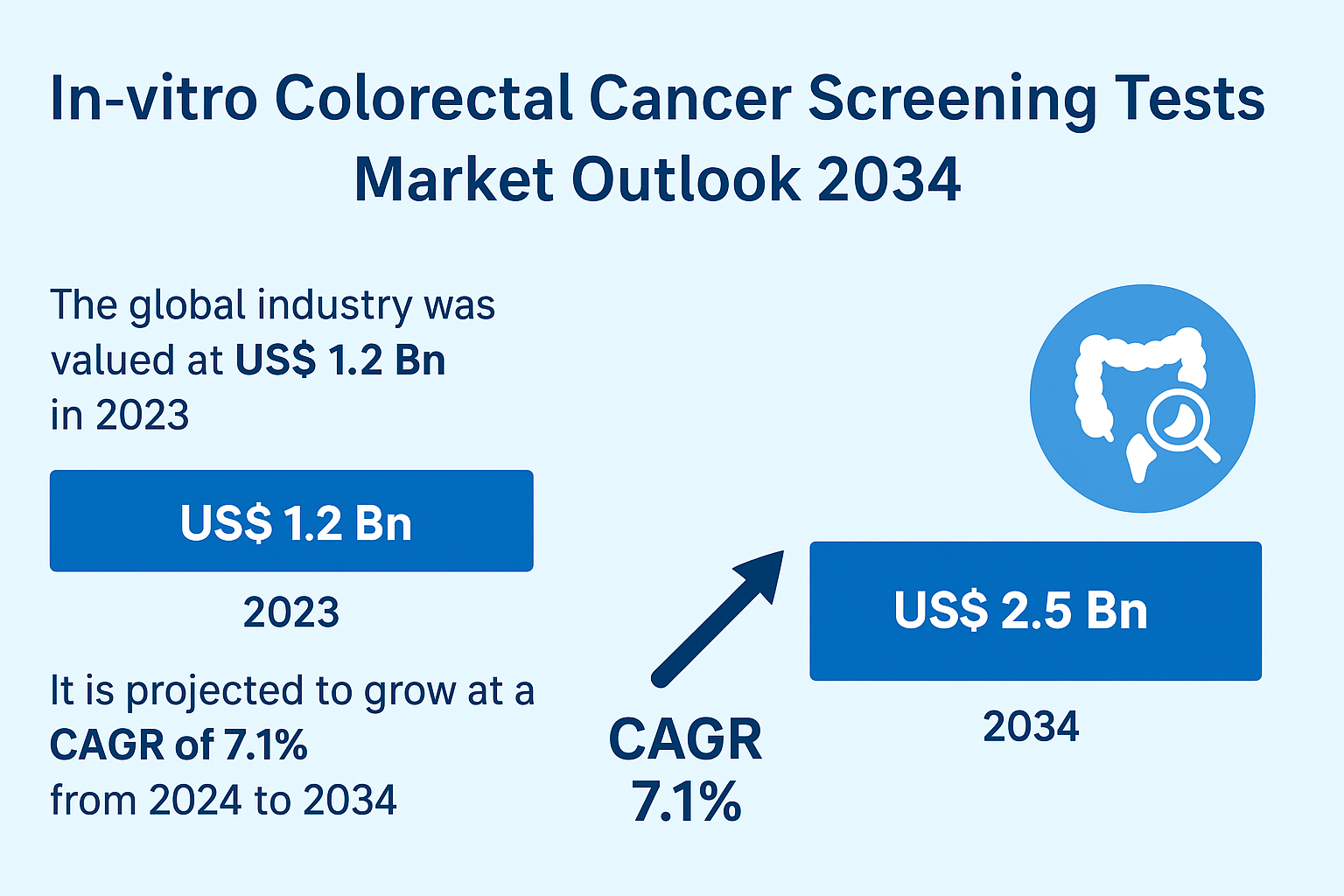

Valued at US$ 1.2 billion in 2023, the market is projected to reach US$ 2.5 billion by 2034, growing steadily at a CAGR of 7.1%. The industry is being reshaped by next-generation biomarker technologies, increased public health investment, and a surge in home-based and clinic-based screening volumes.

This press release provides a detailed exploration of market drivers, clinical relevance, emerging trends, technological innovations, industry strategies, and regional opportunities defining the decade ahead.

1. Market Overview: A Strategic Shift Toward Preventive Oncology

Colorectal cancer remains one of the most preventable yet deadly cancers globally. While colonoscopy remains the gold standard for diagnosis, barriers such as cost, invasiveness, patient hesitation, and limited access in developing regions have accelerated the demand for in-vitro CRC screening tests.

These tests—particularly Fecal Immunochemical Tests (FIT), Fecal DNA Test Kits, and Guaiac Fecal Occult Blood Tests (gFOBT)—are now foundational components of national and regional CRC screening programs.

The combination of rising global health awareness, increasing screening mandates, and growing adoption of non-invasive tests is expected to propel long-term market growth.

2. Factors Fueling Market Growth

2.1 Increasing Global CRC Incidence and Mortality

CRC accounts for millions of new cases and hundreds of thousands of deaths each year. The disease burden is driven by:

-

Sedentary behavior

-

High consumption of red/processed meats

-

Low fiber diet

-

Alcohol consumption and smoking

-

Obesity and metabolic disorders

These lifestyle-related risk factors have compelled global healthcare systems to prioritize early screening strategies. In-vitro tests—due to their ease of use and high compliance—are becoming central to these efforts.

2.2 FIT Remains the Leading Screening Tool Worldwide

The Fecal Immunochemical Test (FIT) continues to dominate the global test portfolio. FIT’s advantages over legacy gFOBT tests include:

-

Higher sensitivity and specificity

-

No dietary restrictions

-

Greater user compliance

-

Quantitative analysis capabilities

-

Suitability for annual mass screenings

FIT remains the backbone of national CRC screening programs in dozens of countries across North America, Europe, and Asia Pacific.

2.3 Growing Adoption of Fecal DNA Test Kits

Fecal DNA tests identify molecular markers associated with cancer and pre-cancer, including:

-

DNA mutations

-

Methylation patterns

-

Abnormal epithelial cell shedding

The success of Cologuard has ushered in a new wave of precision diagnostics. DNA-based tests are increasingly becoming essential for individuals who require more sensitive screening methods or who belong to high-risk categories.

2.4 Hospitals & Clinics Remain Primary End-users

Hospitals and clinics hold the majority share across end-users due to:

-

Integrated diagnostic infrastructure

-

Physician-led screenings

-

Access to follow-up procedures such as colonoscopy

-

Higher patient trust and established workflows

Diagnostic centers and home-collection solutions are increasingly participating in the ecosystem but hospitals maintain dominance due to comprehensive care delivery.

3. Segmentation Analysis

By Test Type

-

Fecal Immunochemical Test (FIT)

-

Fecal DNA Test Kits

-

Guaiac Fecal Occult Blood Test (gFOBT)

-

Others

By End-user

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

FIT continues to lead; DNA tests are growing rapidly; diagnostic centers are gaining traction in urban regions.

4. Regional Market Outlook

4.1 North America – The Epicenter of Screening Activity

North America dominates the global market due to:

-

High CRC incidence

-

Structured screening guidelines

-

Strong reimbursement systems

-

FDA-cleared advanced tests like Cologuard and Shield™

-

Growing adoption of blood-based CRC diagnostics

With the U.S. recording over 106,000 new colon cancer cases and 46,000 rectal cancer cases annually, screening remains a core public health mandate.

4.2 Europe – Strong Policy Support and Widespread Test Accessibility

Europe performs some of the world’s highest screening rates, supported by:

-

Government-funded FIT-based programs

-

Universal healthcare systems

-

High awareness among older adults

-

Growing molecular diagnostic market

Nations such as the U.K., France, Germany, Italy, and Spain are key contributors to the region’s strong growth trajectory.

4.3 Asia Pacific – The Fastest-growing Region with a Massive Screening Gap

Asia Pacific presents enormous growth opportunities due to:

-

Rapidly increasing CRC incidence in China and India

-

High participation in FIT screening in Japan and South Korea

-

Expanding diagnostic infrastructure

-

Growing demand for at-home test kits

With more than half of the global population residing in the region, the potential for large-scale screening adoption is unprecedented.

4.4 Latin America & Middle East/Africa – Emerging Frontiers

These regions are slowly adopting CRC screening programs, driven by:

-

Rising investments in healthcare systems

-

Increasing partnerships with diagnostics companies

-

Greater availability of low-cost tests

Despite infrastructural challenges, long-term market opportunities remain substantial.

5. Competitive Landscape and Strategic Positioning

The industry is moderately fragmented with a mix of global leaders and emerging innovators. Companies are actively expanding their diagnostic portfolios and enhancing geographic penetration.

Leading Companies Include:

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc.

-

Eiken Chemical Co., Ltd

-

Qiagen

-

Quest Diagnostics Incorporated

-

Sentinel CH. SpA

-

Quidel Corporation

-

Freenome Holdings, Inc.

-

Immunostics, Inc.

-

BTNX, Inc.

Strategies being deployed include:

-

Precision biomarker development

-

Partnerships with hospitals & laboratories

-

Launch of next-generation DNA and RNA tests

-

Entry into emerging Asian and Latin American markets

6. Key Industry Advancements

Guardant Health’s Shield™ Blood Test (2023)

One of the most transformative advancements is Guardant Health’s introduction of Shield™, a blood-based CRC screening test launched in South Korea through Samsung Medical Centre.

This test is rapidly reshaping screening accessibility for individuals reluctant to undergo stool-based testing.

Geneoscopy Partners with Labcorp to Expand CRC Screening Access

Geneoscopy’s collaboration with Labcorp supports nationwide access to its innovative RNA-based stool diagnostic—representing one of the most advanced non-invasive screening solutions available.

7. Innovation Trends Transforming the Market

7.1 AI-Powered Diagnostic Algorithms

Artificial intelligence is ushering in a new era of interpretation accuracy, enabling:

-

Enhanced biomarker detection

-

Predictive risk modeling

-

Personalized screening schedules

-

Automated laboratory workflows

This technology is expected to drastically improve test reliability and clinical utility.

7.2 Growth of Liquid Biopsy and Blood-based Screening

Blood-based CRC screening is gaining traction for its convenience and strong compliance potential. Research into circulating tumor DNA (ctDNA), methylated genes, and protein signatures is expanding rapidly.

This segment is expected to grow significantly as tests gain regulatory approvals and become more widely covered by insurers.

7.3 Digital & At-home Screening Integration

Smart diagnostic ecosystems now enable:

-

Home collection

-

App-guided instructions

-

Digital reminders

-

Result tracking

-

Telehealth follow-ups

This digital integration is improving adherence and enhancing patient involvement in preventive care.

7.4 Multi-analyte Testing and Biomarker Diversity

Next-generation tests are expected to incorporate:

-

Genetic mutations

-

Epigenetic markers

-

RNA transcripts

-

Protein biomarkers

These multi-target approaches promise superior sensitivity and specificity.

8. Market Opportunities and Barriers

Opportunities

-

Expansion of government-led screening initiatives

-

Demand surge in developing regions

-

Strong investment in genomic R&D

-

Integration of AI into diagnostics

-

Availability of home-based kits

Barriers

-

Limited awareness in rural and low-income areas

-

Stigma associated with stool testing

-

Infrastructure gaps in emerging markets

-

Variability in test accuracy across population types

Strong multi-stakeholder efforts will be required to overcome these challenges.

9. Future Outlook: 2024–2034

The global In-vitro Colorectal Cancer Screening Tests Market is entering a period of unprecedented potential. Innovations in biomarker science, digital diagnostics, and at-home screening ecosystems are reshaping CRC screening accessibility worldwide.

The projected rise to US$ 2.5 billion by 2034 reflects not only increasing demand but also a major shift in clinical practice—from reactive treatment to proactive prevention.

With governments, healthcare providers, and diagnostic manufacturers aligned toward early detection, the decade ahead promises to significantly reduce CRC morbidity and mortality.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness