Business Travel Accident Insurance Market Research Report: Growth, Share, Value, Size, and Analysis By 2034

Comprehensive Outlook on Executive Summary Business Travel Accident Insurance Market Size and Share

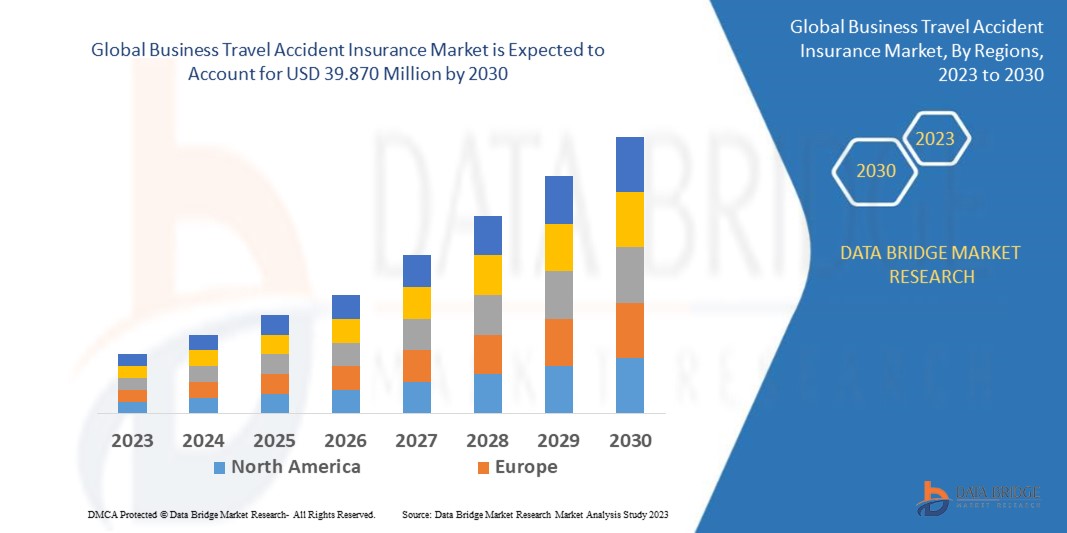

Data Bridge Market Research analyses that the global business travel accident insurance market which was USD 3.970 million in 2022, is expected to reach USD 39.870 million by 2030, and is expected to undergo a CAGR of 9.90% during the forecast period 2023-2030.

This competitive era calls for businesses to be equipped with knowhow of the major happenings of the market and Business Travel Accident Insurance Market This Business Travel Accident Insurance Market research report is comprehensive and object-oriented which is structured with the grouping of an admirable industry experience, talent solutions, industry insight and most modern tools and technology. To acquire knowhow of market landscape, brand awareness, latest trends, possible future issues, industry trends and customer behaviour, this finest Business Travel Accident Insurance Market research report is very crucial. This Business Travel Accident Insurance Market report covers all the studies and estimations that are involved in the method of standard market research analysis.

Business Travel Accident Insurance Market report comprises of all the crucial parameters mentioned above hence it can be used for your business. Furthermore, systemic company profiles covered in this report also explains what recent developments, product launches, joint ventures, mergers and acquisitions are taking place by the numerous key players and brands in the market. Business Travel Accident Insurance Market report also endows with company profiles and contact information of the key market players in the key manufacturer’s section. The Business Travel Accident Insurance Market report is provided with the transparent research studies which have taken place by a team work of experts in their own domain.

Access expert insights and data-driven projections in our detailed Business Travel Accident Insurance Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-market

Business Travel Accident Insurance Industry Snapshot

Segments

- Based on insurance type, the Business Travel Accident Insurance market can be segmented into Personal Accident Insurance, Medical Evacuation, Repatriation of Remains, Accidental Death and Dismemberment, and Others. Personal Accident Insurance is expected to dominate the market due to the increasing priority placed by businesses on the well-being and safety of their employees during travel.

- In terms of distribution channel, the market can be categorized into Direct Sales and Distributor. Direct Sales are projected to have a larger market share as it offers a more personalized approach and better customer service.

- On the basis of end-user, the market can be divided into Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large enterprises are anticipated to hold a significant share as they have a higher number of employees traveling for business purposes.

Market Players

- Allianz Global Assistance

- AXA

- InsureandGo

- The Co-operators

- American International Group, Inc.

- Chubb

- Zurich

- Munich Re

- Sompo Japan Nipponkoa Insurance Inc.

- Tokio Marine HCC

- The Hartford

- Travel Insured International

- Ping An Insurance

- Starr Insurance Companies

- Swiss Re

The Global Business Travel Accident Insurance Market is witnessing significant growth due to the rise in business travel activities across various industries. The increasing awareness among companies about the importance of ensuring the safety and well-being of their employees during travel has led to a surge in demand for business travel accident insurance. Factors such as the growing number of international assignments, rise in business expansion globally, and stringent regulations emphasizing employee safety are driving the market forward.

North America is expected to dominate the market due to the presence of key players and the high adoption rate of business travel accident insurance in the region. However, the Asia Pacific region is projected to witness the fastest growth during the forecast period owing to the booming business travel sector in countries like China and India. Moreover, the increasing investments by insurance companies in developing innovative and comprehensive insurance products tailored for business travelers are fueling market growth.

In conclusion, the Global Business Travel Accident Insurance Market is poised for substantial growth in the coming years as companies prioritize the safety and security of their employees during business travels. The market players are focusing on expanding their product portfolios and enhancing customer experience to gain a competitive edge in the market.

The Global Business Travel Accident Insurance Market is experiencing a robust growth trajectory, driven by the escalating demand for comprehensive insurance coverage for employees engaged in business travel activities. One key trend that is reshaping the market dynamics is the increasing emphasis placed by organizations on the safety and well-being of their workforce during travel, leading to a surge in the adoption of business travel accident insurance. Businesses across various industries are recognizing the significance of mitigating risks associated with employee travel, thereby bolstering the market growth.

A noteworthy development in the market is the expanding product portfolios of key market players to cater to the evolving needs of business travelers. Companies such as Allianz Global Assistance, AXA, and Chubb are focusing on developing innovative insurance solutions that provide extensive coverage for accidents, medical emergencies, and repatriation services. This strategic approach not only enhances the value proposition for customers but also strengthens the competitive position of these market players in the global landscape.

Another critical factor influencing the market is the regulatory landscape governing employee safety standards during business travel. Stringent regulations aimed at safeguarding the interests of workers while they are on official trips are propelling organizations to invest in robust insurance coverage to mitigate potential liabilities. This regulatory environment is creating a conducive market scenario for insurance providers, driving the uptake of business travel accident insurance across sectors.

Moreover, the geographical outlook of the market presents compelling opportunities for growth and expansion. While North America is poised to maintain its dominance in the market, driven by the presence of established insurance players and a mature business travel ecosystem, the Asia Pacific region stands out as a high-growth market. Countries such as China and India are witnessing a surge in business travel activities, fueled by economic growth and globalization trends. As a result, insurance companies are ramping up their presence in the region, offering tailored insurance products to cater to the evolving needs of businesses operating in Asia Pacific.

In conclusion, the Global Business Travel Accident Insurance Market is characterized by increasing demand, regulatory tailwinds, and geographic expansion opportunities. As companies continue to prioritize employee safety and risk management in business travel, the market is poised for sustained growth. Market players that focus on innovation, product differentiation, and customer-centric strategies are likely to thrive in this dynamic landscape, meeting the evolving needs of businesses and employees in a rapidly changing business travel environment.The Global Business Travel Accident Insurance market is witnessing notable growth propelled by the increasing recognition of the importance of ensuring the safety and well-being of employees during business travels. Businesses across various sectors are realizing the significance of mitigating risks associated with employee travel, thus driving the demand for comprehensive insurance coverage. This trend is reshaping the market dynamics, with organizations placing a higher emphasis on employee safety and security during travel. As a result, there has been a surge in the adoption of business travel accident insurance to safeguard employees and mitigate potential liabilities.

Market players such as Allianz Global Assistance, AXA, and Chubb are actively expanding their product portfolios to cater to the evolving needs of business travelers. By developing innovative insurance solutions that provide extensive coverage for accidents, medical emergencies, and repatriation services, these companies are enhancing their competitive positions and value propositions for customers. This strategic approach not only meets the growing demand for comprehensive coverage but also strengthens customer trust and loyalty in the market.

The regulatory landscape surrounding employee safety standards during business travel is another critical factor influencing the market. Stringent regulations aimed at safeguarding the interests of workers on official trips are prompting organizations to invest in robust insurance coverage to comply with regulations and protect their employees. This regulatory environment is creating a conducive market scenario for insurance providers, encouraging the uptake of business travel accident insurance across industries.

Geographically, North America is expected to maintain its dominance in the market, driven by the presence of established insurance players and a mature business travel ecosystem. However, the Asia Pacific region presents significant growth opportunities due to the increasing business travel activities in countries like China and India. Economic growth and globalization trends are fueling the demand for business travel accident insurance in the region, prompting insurance companies to tailor their products to meet the specific needs of businesses operating in Asia Pacific.

In conclusion, the Global Business Travel Accident Insurance Market is characterized by increasing demand, regulatory compliance requirements, and geographic expansion opportunities. As organizations prioritize employee safety and risk management during business travels, the market is poised for sustained growth. Market players that focus on innovation, product differentiation, and customer-centric strategies are likely to excel in this dynamic landscape, meeting the evolving needs of businesses and employees in an ever-changing business travel environment.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-business-travel-accident-insurance-market/companies

Market Intelligence Question Sets for Business Travel Accident Insurance Industry

- How big is the current global Business Travel Accident Insurance Market?

- What is the forecasted Business Travel Accident Insurance Market expansion through 2032?

- What core segments are covered in the report on the Business Travel Accident Insurance Market?

- Who are the strategic players in the Business Travel Accident Insurance Market?

- What countries are part of the regional analysis in the Business Travel Accident Insurance Market?

- Who are the prominent vendors in the global Business Travel Accident Insurance Market?

Browse More Reports:

North America Machined seals Market

Asia-Pacific Medical Foods for Inborn Errors of Metabolism Market

Middle East and Africa Medical Foods for Inborn Errors of Metabolism Market

North America Medical Foods for Inborn Errors of Metabolism Market

Argentina Menopause Drugs Market

Chile Menopause Drugs Market

North America Modular Data Center Market

North America Nuclear Imaging Devices Market

Europe Nuclear Imaging Devices Market

Asia-Pacific Nuclear Imaging Devices Market

Asia-Pacific Nut Processing Equipment Market

Europe Nut Processing Equipment Market

Middle East and Africa Nut Processing Equipment Market

North America Nut Processing Equipment Market

Europe Octabin Market

North America Hepatitis B Infection Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness